NH lawmakers are reviewing a new GOP school funding plan

Advocates for school funding gathered outside the NH State House on April 6, 2023, as House members prepared to vote on the state budget. Josh Rogers—NHPR

|

Published: 03-27-2024 11:31 AM

Modified: 03-27-2024 11:48 AM |

A top Republican budget writer in the New Hampshire House has proposed boosting state aid to public schools by $400 million a year and requiring any future education spending increase made at the local level to be approved by a supermajority vote.

Hampton Rep. Tracy Emerick's plan relies on “redefining” local property taxes as statewide property taxes. It's the most significant legislative response yet since a Rockingham County Superior Court ruling late last year in an ongoing school funding lawsuit, which could force an overhaul of how New Hampshire pays for public education.

In November, Judge David Ruoff ruled that the state should increase its per-pupil grants to schools by at least 75% – from about $4,200 per student to more than $7,000 per student.

School funding reform advocates say Ruoff’s ruling could help pave the way for a more equitable method of funding local schools, but critics — including Gov. Chris Sununu — say it amounts to judicial overreach. As reported by the New Hampshire Bulletin, the state Supreme Court recently paused Ruoff's order, giving the state more time to challenge it.

Introducing his new funding proposal before the House Finance Committee Tuesday, Emerick said he took Ruoff’s ruling as a starting point.

“It was a recommendation that he’s calculated," Emerick told fellow lawmakers. "So when I put the amendment together, I just took his number."

Emerick’s plan would require property-rich communities — towns that raise more money via the statewide property tax than they need to cover the base cost of an adequate education — to send their "excess payment” back to the state. Under Emerick’s plan, that would amount to about $90 million dollars. That “excess” money would then be redistributed to districts with smaller tax bases.

Several committee members questioned Emerick about how his proposal would affect local taxpayers. He stressed he was shooting for minimal disruption.

Article continues after...

Yesterday's Most Read Articles

With Concord down to one movie theater, is there a future to cinema-going?

With Concord down to one movie theater, is there a future to cinema-going?

“It’s beautiful” – Eight people experiencing homelessness to move into Pleasant Street apartments

“It’s beautiful” – Eight people experiencing homelessness to move into Pleasant Street apartments

No deal. Laconia buyer misses deadline, state is out $21.5 million.

No deal. Laconia buyer misses deadline, state is out $21.5 million.

Quickly extinguished fire leaves Concord man in critical condition

Quickly extinguished fire leaves Concord man in critical condition

Concord police ask for help in identifying person of interest in incidents of cars being keyed during Republican Party event

Concord police ask for help in identifying person of interest in incidents of cars being keyed during Republican Party event

Update: Victim identified in Lantern Lane fire in Concord

Update: Victim identified in Lantern Lane fire in Concord

“The net effect to the taxpayer is no increase,” he said. "All it is is redefining local taxes as statewide property tax.”

But critics were quick to differ. Waterville Valley Town Manager Mark Decoteau serves as the spokesman for Educational Coalition Companies 2.0, a group of cities and towns that oppose redistributing statewide property tax revenues. He estimated that, under Emerick's proposal, “$88.4 million for education will have to be raised by selected cities and towns."

“That basic concept is fundamentally wrong," Decoteau said.

Doug Hall — a former Republican lawmaker from Chichester who spent decades analyzing how New Hampshire pays for schools — meanwhile targeted the bill’s supermajority requirement for additional school aid increases at the local level. He said requiring those decisions to be subject to a two-thirds majority vote would effectively lock in existing disparities between rich and poor districts.

“Districts with large class sizes will not be able to reduce them to levels already available in other districts," Hall said. "Every expensive special education student who moves into a small town, will necessarily result in a reduction of the funds available for the education of every other student."

Deb Howes, with the American Federation of Teachers, praised the idea of lifting state grants for every student but worried that the architecture of Emerick’s plan would impair the state’s ability to target the varied needs of school districts.

“We are concerned that this amendment puts its eggs into one basket,” Howes said.

The House Finance Committee is scheduled to hold a work session on the proposal Wednesday, where state revenue officials are expected to provide input on the proposal.

Committee Chairman Key Weyler encouraged lawmakers to bring their ideas.

“This was the decision of the court, and this is how we try to deal with it," Weyler said. "If there is another way we are open to entertain it."

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game

Voice of the Pride: Merrimack Valley sophomore Nick Gelinas never misses a game With less than three months left, Concord Casino hasn’t found a buyer

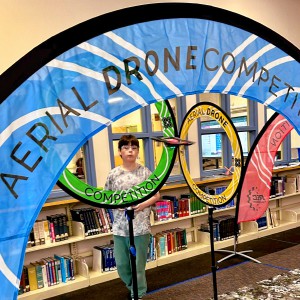

With less than three months left, Concord Casino hasn’t found a buyer Kearsarge Middle School drone team headed to West Virginia competition

Kearsarge Middle School drone team headed to West Virginia competition Phenix Hall, Christ the King food pantry, rail trail on Concord planning board’s agenda

Phenix Hall, Christ the King food pantry, rail trail on Concord planning board’s agenda